Introduction

Social Impact Bonds (SIBs) are innovative financial instruments that have emerged in recent years as a new way to tackle complex social challenges. They represent a fusion of private investment and social welfare, aiming to improve social outcomes while delivering a return on investment for stakeholders. These bonds bring together governments, private investors, and service providers with a shared goal: to create measurable improvements in society, whether in education, healthcare, criminal justice, or employment services.

By linking financial returns to social impact, Social Impact Bonds offer a novel approach to solving persistent social problems that have long resisted traditional funding methods. As governments and nonprofits face increased pressure to do more with less, SIBs provide an opportunity to leverage private capital in pursuit of long-term social change. This article explores the potential of Social Impact Bonds, how they work, their benefits, challenges, and the future of this model in addressing global social issues.

What Are Social Impact Bonds?

Social Impact Bonds are a type of performance-based contract that focuses on achieving specific social outcomes. They are a form of outcome-based financing where private investors provide upfront capital to fund social programs. These programs are designed to achieve measurable outcomes in areas such as public health, education, employment, and criminal justice.

The unique aspect of SIBs is that the government or other payers only repay the investors if the predetermined social outcomes are successfully achieved. This creates a results-driven approach where the primary goal is not simply to fund programs but to ensure that those programs have tangible, positive impacts on society.

Social Impact Bonds can be seen as a win-win situation for all parties involved: the investors take on the financial risk, the government or other stakeholders only pay for results, and social service providers are incentivized to improve their programs and outcomes. This model is particularly useful when addressing complex social issues that are difficult to solve with traditional methods.

How Do Social Impact Bonds Work?

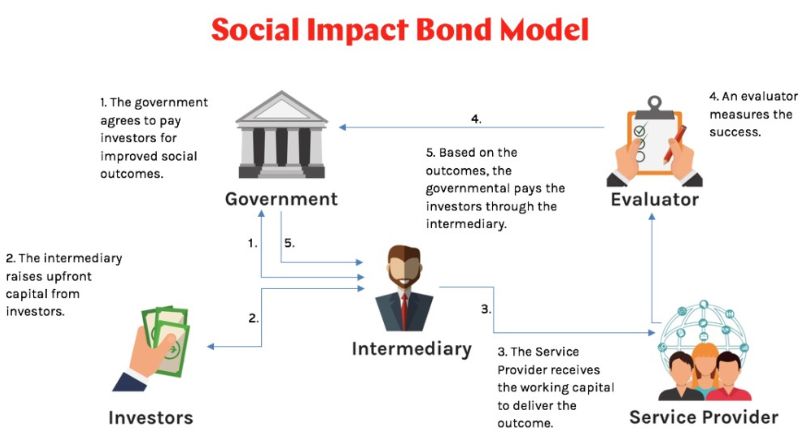

The process of launching a Social Impact Bond typically involves several steps and key stakeholders, each playing an essential role in ensuring the success of the project. These include the government or public authority, private investors, service providers, and intermediaries who help manage the process. Here’s a breakdown of how SIBs generally work:

-

Identifying the Social Issue: The first step is to identify a pressing social issue that requires intervention. This could be anything from reducing recidivism in prisons to improving access to education or healthcare.

-

Designing the Program: A program or intervention is designed to address the identified issue. This is typically done by social service providers, often with guidance from experts, research, and data analysis.

-

Securing Private Investment: Private investors provide the capital needed to fund the program. These investors take on the financial risk, meaning they only receive a return if the program meets its performance targets. These investors could include philanthropic organizations, venture capital firms, or even social impact funds.

-

Implementing the Program: The social service providers carry out the program on the ground, aiming to achieve the agreed-upon social outcomes. This could involve offering support services, providing education, or delivering healthcare interventions.

-

Measuring and Reporting Outcomes: Once the program is in place, the outcomes are closely monitored and evaluated. Independent evaluators assess whether the program has achieved the desired social impact, often through data-driven analysis and rigorous performance metrics.

-

Payment for Results: If the program meets its performance targets, the government or other payers reimburse the investors. The amount paid typically reflects the degree of success in achieving the outcomes. The more successful the program is, the higher the return on investment for the private investors.

This outcome-based financing model helps to align the interests of all stakeholders and ensures that resources are only allocated to initiatives that demonstrate real and measurable success.

Benefits of Social Impact Bonds

Social Impact Bonds offer numerous benefits, not just to the parties directly involved, but to society as a whole. Below are some of the key advantages of this model:

1. Focus on Results

One of the main benefits of Social Impact Bonds is that they place a strong emphasis on measurable results. Traditional funding models may not always be accountable for outcomes, leading to inefficiencies and limited impact. With SIBs, however, the focus is squarely on achieving specific social outcomes, which drives efficiency and ensures that resources are being used effectively.

2. Risk Mitigation for Governments

Governments face financial constraints and are often hesitant to invest in unproven programs. Social Impact Bonds mitigate some of this risk by shifting the financial burden to private investors. Governments only pay if the program delivers results, making it an attractive way to tackle social issues without upfront financial commitment.

3. Encouraging Innovation

Social Impact Bonds encourage innovative solutions to longstanding social problems. Since the funding is tied to outcomes, service providers are incentivized to think creatively and adopt new, more effective methods for achieving their goals. This often leads to more cutting-edge approaches to solving social issues, ultimately benefiting society.

4. Attracting Private Investment

SIBs open the door for private capital to be invested in social programs. This allows social initiatives to secure much-needed funding, which might otherwise be difficult to obtain through traditional sources such as government grants or donations. The involvement of private investors also brings business acumen, expertise, and efficiency to the programs being implemented.

5. Building Public-Private Partnerships

By their nature, SIBs require collaboration between the public and private sectors. This fosters stronger partnerships between governments, investors, and social service providers, facilitating a more coordinated approach to tackling social issues. Public-private partnerships are key to addressing complex, systemic challenges that cannot be solved by any single sector alone.

Challenges of Social Impact Bonds

While Social Impact Bonds have immense potential, they also come with their share of challenges. Some of the key obstacles include:

1. Complexity of Design and Implementation

Designing and implementing an SIB can be a complex and time-consuming process. The programs must be carefully structured, with clear, measurable outcomes and a well-defined evaluation process. The evaluation of social outcomes also requires high-quality data, which may not always be readily available.

2. High Transaction Costs

SIBs can involve high transaction costs due to the need for intermediaries, legal agreements, and monitoring and evaluation systems. These costs can erode the potential returns on investment and reduce the overall effectiveness of the model.

3. Difficulty in Defining Outcomes

Measuring social outcomes can be challenging, especially in areas like education, health, or social inclusion, where long-term results can be hard to quantify. Defining clear, realistic, and measurable targets is crucial for the success of SIBs, but this can be a difficult task when dealing with complex social issues.

4. Dependence on Private Capital

SIBs rely on private investors to fund social programs, which means they are subject to market conditions and the availability of capital. In times of economic downturn or financial instability, private investment in social programs may decrease, limiting the ability to scale or sustain SIB initiatives.

The Future of Social Impact Bonds

Despite the challenges, the future of Social Impact Bonds looks promising. The model is still evolving, and as more data and evidence accumulate, it will become clearer how SIBs can be optimized for greater impact. Many governments and social organizations are exploring new ways to make SIBs more effective, including expanding the range of social issues they address and finding ways to lower transaction costs.

The global interest in SIBs continues to grow, with several successful case studies emerging from countries such as the United Kingdom, the United States, and Australia. These early successes offer valuable lessons that can be applied to future projects, and as the model matures, we can expect to see more widespread adoption.

Moreover, the growing focus on social and environmental impact investing aligns with the goals of SIBs. Investors are increasingly interested in generating both financial returns and positive social outcomes, making SIBs an attractive option in the broader landscape of impact investing.

Conclusion

Social Impact Bonds represent a promising approach to addressing some of society’s most persistent challenges. By aligning private investment with social outcomes, SIBs create a framework that incentivizes efficiency, innovation, and measurable results. While there are challenges to overcome, the potential of Social Impact Bonds to drive meaningful change is vast, and as the model evolves, it is likely to become an increasingly important tool in tackling global social issues.

The success of Social Impact Bonds relies on a collaborative effort between governments, private investors, and service providers, each committed to achieving measurable social outcomes. As we continue to explore new ways to unlock the potential of this innovative model, it holds the promise of a more sustainable and inclusive future for all.